New market analysis shared exclusively with Digital Textile Printer shows that in 2024 total value in digital textile printing worldwide will reach €4.80 billion. The data from the recently published Smithers study The Future of Digital Textile Printing to 2028 show that a total of 3.80 billion square metres of garments, signage, technical textiles and household furnishings will be printed on inkjet machines this year.

Continued growth

Across the past decade textile work has emerged as a highly attractive diversification opportunity for mainstream inkjet OEMs. Output did see a major deflection at the beginning of the decade, with Covid contributing to a 25% drop in output from 2019 – 2020. Volumes have now recovered, and structural evolution in the textile industry will help further adoption of digital through to 2030 and beyond.

Applications for digital fabric printing is far from saturated. By volume, inkjet still only accounts for around 7% of contemporary printed textile output.

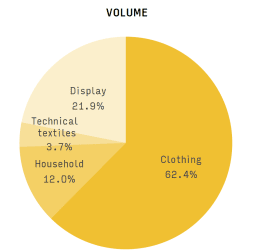

Clothing is by far the biggest application for digitally-printed textiles

Smithers estimates that global volumes of inkjet printed textiles will increase at a +10.3% compound annual growth rate (CAGR) for 2023 – 2028; almost double the rate seen for the preceding five years. This will see digital textile output reach 3.54 billion square metres in 2028.

Across the same Smithers forecast period a CAGR of +9.7% will drive value to €6.86 billion, at constant pricing.

Market segments

Apparel continues to be the most lucrative part of the market, worth €3.40 billion in 2024. This segment accounted for most of the losses in volume seen at the beginning of the decade. It is now growing strongly however, leveraging new e-commerce and digital supply chain tools. Smithers forecasts the fastest growth in fashion garments, swimwear, and sportswear across 2023-2028.

The second largest segment – indoor and outdoor displays – also suffered during Covid, but its recovery has been slower, as advertising budgets have been cut and are increasingly being directed to online channels. This segment will have the slowest growth rate across the next five years.

The outlook for home furnishing is also below the market average. In contrast to other segments, however, it has seen steady growth over the decade. Largely unaffected by Covid, print service providers were able to capitalise on consumers’ decisions to invest in bespoke curtains, floor coverings and upholstery, as part of lockdown-inspired refurbishments.

Technical textiles also have a positive market outlook, mainly due to demand for inkjet-printed fabrics in medical and automotive manufacturing.

Innovations and challenges

There are two key focus areas for development of digital textile printing technology: increased productivity and greater sustainability.

Multiple manufacturers of digital textile printing equipment are introducing new models that feature enhanced productivity – including more installations of more complex high-speed single-pass inkjet presses. Relative to multi-pass configurations, single-pass printing is fast – the new EFI Reggiani Bolt XS can print 150sqm/minute in some modes, for example.

Single-pass presses are more expensive though, as the printhead array is the same width as the maximum print width, and each colour has a discrete set of printheads, together with all of the accompanying ink management system and supporting circuitry.

Furthermore high levels of operator training are required to maintain print quality, along with frequent technical maintenance.

For sustainability, inkjet already presents a more planet-friendly option to conventional print or dyeing, which use high volumes of water, produce waste, and often pollute local waterways. As apparel retailers have moved towards an ethos of sustainable fashion it has aided the further penetration of inkjet printed clothing.

This is recognised by initiatives to recognise more sustainable garment production, and legislation to reduce the emissions impact of textile production.

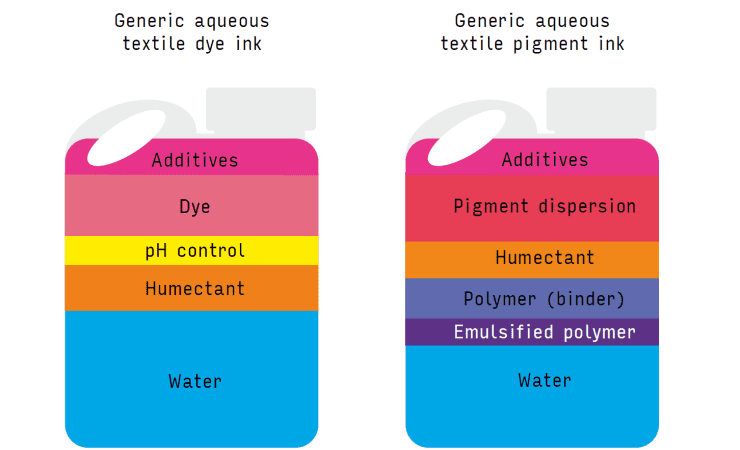

Pigment inks are already popular in many analogue textile print systems, and require much less steaming, washing and other post-print treatments. Furthermore, pigment printed clothing is easier to recycle at end-of-life.

In digital print, these inks are an increasingly attractive alternative to dyes, and also expand the range of fabrics that can be printed with inkjet. To capitalise on this, formulations need to have their viscosity and surface tension requirements calibrated carefully, and pre-treatments are often still necessary to ensure uniform penetration of the textile fibres.

The transition to pigment printing is most advanced in for home furnishings, but dye inks remain the dominant technology in garments. Across all the 30 digital textile application Smithers analysis covers, pigment inks represent just 4.5% of output by surface area.

The Future of Digital Textile Printing to 2028, edited by John Nelson, is available to purchase now from Smithers. It combines market analysis with a comprehensive global data set segmenting this market by substrate type, end-use application, ink type, geographic region, and leading national markets.